In order for your Beany accountant to get to work on your year-end accounts and tax returns, we need some information from you. This is collected through our short and easy annual tax minimiser questionnaire. The questionnaire is designed to ask exactly what we need to know, and not require extra documents from you.

How does it work?

Original Dashboard

- Sign in to your Beany page and select 'Annual Accounts

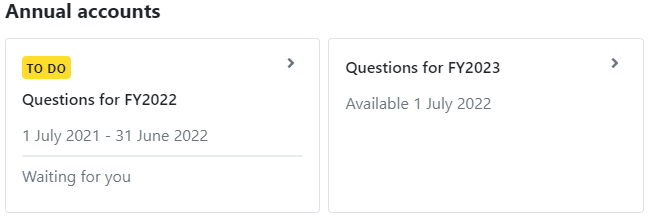

- Look for the "To Do" which indicates the financial years that are open for you. Select the name of the organisation you're ready to answer questions for by clicking on it.

New Dashboard

- Sign in to your Beany page, and look for the "Annual Accounts" heading which will have a "to do" flag on your dashboard.

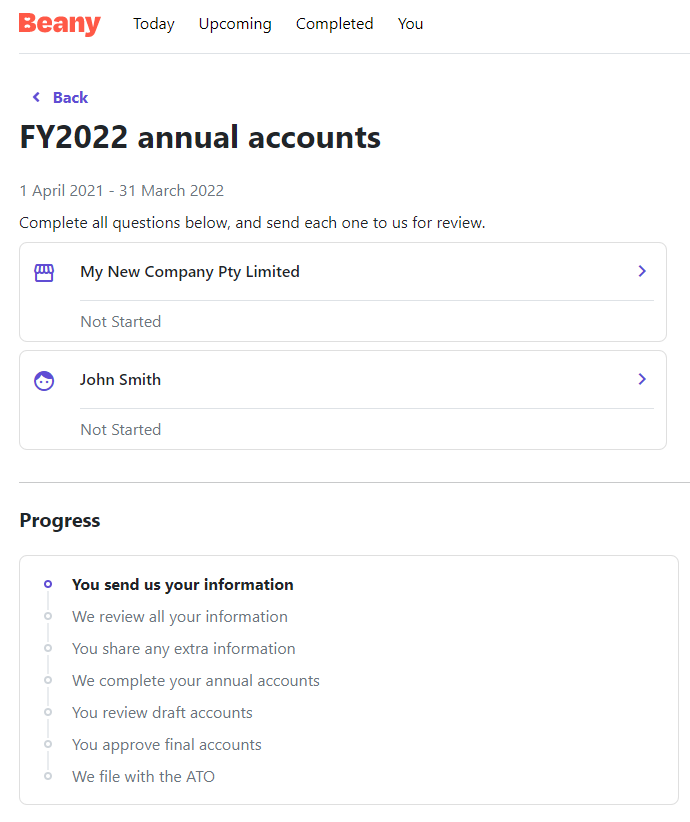

- Selecting any year with a "to do" flag will take you to the questionnaires for that year. You'll be able to see which ones are still to complete, and how far through each you are. Select the name of your organisation or personal record to get started.

Both Dashboards

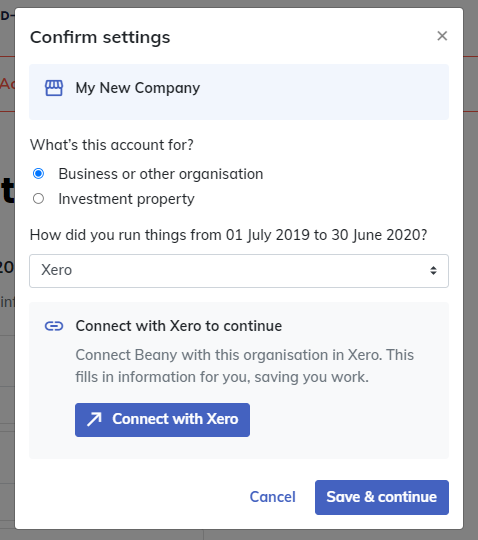

- The first time you use the questionnaire you'll see the setup screen - make sure we've correctly identified your business type and software. If you're using Xero you'll need to connect it now.

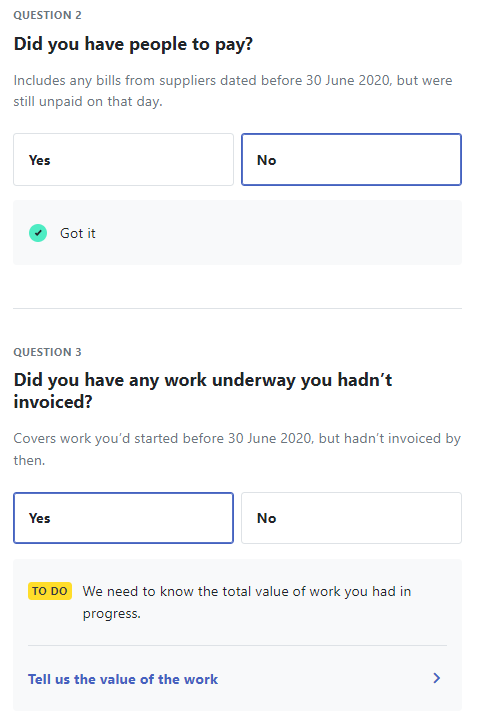

- Answer all the questions - if you answer no then there is nothing further required. Yes will mean providing us with some additional information (you'll see the "to do" pop up again).

- Once you're done, you'll see the green progress bar complete at the top of the screen. Hit the "send to accountant" button, then continue on to any other sets of questions you might need to answer.

- Once you've submitted every questionnaire, the information will be sent straight to your accountant

- Sit back and relax - Beany has it under control! We'll be in touch within 4 weeks if we need more info, or once we have your drafts ready for review. If it's busy season and taking a bit longer, we'll be sure to let you know also.

At any time if you need assistance, get stuck or have questions, just contact Beany Support.